Members Charter

Dedicated to improving our community and your financial future

Vision Statement

In 2021, we embarked on a journey to update our vision statement. The world is changing around us and so is the credit union. To reflect those changes and the changes that are yet to come, we created a dynamic committee.

Through consultation with our staff, our youth committee, board and volunteers, we came up with a statement that motivates us to serve our community for years to come.

Values

Palmerstown Credit Union operates in accordance with the following values:

- Integrity and Respect - We act in a forthright and honest manner treating all our Members with courtesy, respect and concern for their dignity and needs.

- Empathy - We see our Members as individuals and partners in our organisation. We listen, learn and work together to find solutions based on individual needs.

- Excellence - We conduct ourselves to the highest standards for the benefit of our Members.

- Social Responsibility - We care about and consider ourselves part of the community. We strive to give back where we can, to the people we serve.

- Governance - We implement appropriate governance structures to safeguard the interests of all our Members.

Our Motto ‘Our Community, Your Credit Union’

Our Journey

A Brief History of Palmerstown Credit Union

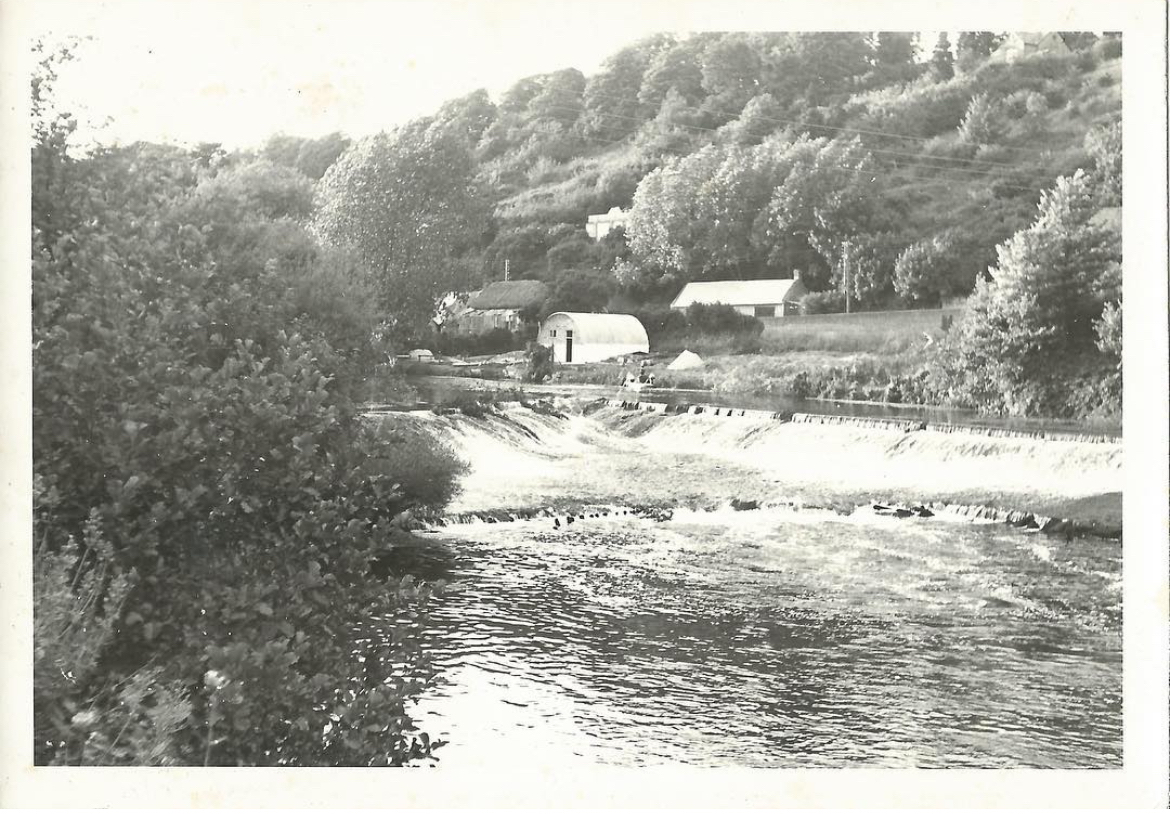

Pre-1960

As a then sleepy village on the outskirts of Dublin, Palmerstown resembles a small rural town in size and facilities. Only a small number of housing estates in existence (Palmerstown Drive and Avenue, Turret Road) among sprawling fields and open countryside.

1960

Dublin property boom results in building of Manor Park, Manor Road and Culmore Road housing. Average Manor Road prices: £1,700 at a time when average wage was £10 per week.

1962

Initial phase of houses are occupied; area continues to take shape with advent of Glenmaroon, Culmore, Wheatfield and Glenaulin roads.

1968

The houses of “New Palmerstown” are completed. As the new community starts to become assimilated into the existing parish of Palmerstown, the need arises to engender a cooperative community spirit among residents old and new, leading to the formation of Palmerstown / Chapelizod Credit Union.

May 3rd, 1968

First meeting of Palmerstown / Chapelizod Credit Union sees caretaker Board set up. Credit Union initially runs out of school kitchen of St Brigid’s Girls School every Friday evening.

June 3rd, 1968

Credit Union membership already stands at 93, with income from shares and fees totalling £373.

July, 1968: Membership rises to 151. Nine loans to the value of £115 paid out by this stage.

October 3rd, 1969

First permanent base - the bungalow at No.2 Palmerstown Avenue - is purchased from a local solicitor, Mr Grogan, for the sum of £5,500.

October 10th, 1969

Chapelizod branch office opens in temporary settings of Chapelizod National School, again operating on Friday evenings.

October 1999

After 30 years in “the bungalow”, the size and requirements of Palmerstown Credit Union require moving again to bigger, more suitable premises. 48 Manor Road is purchased for £616,000, a cost offset by the sale of 2 Palmerstown Avenue for £350,000.

September 2014

Membership stood at 8,695, with a share value of just over €30 million and loans to the value of €14.9 million.

September 2017

Membership stood at 8,676, with a share value of just over €32 million and loans to the value of €12.1 million.

May 2018

Marks the 50th anniversary of Palmerstown Credit Union, serving the communities of Palmerstown and Chapelizod. We have expanded our service offering hugely in the last number of years and now include online facilities where members can apply for a loan online, make payments into their account, transfer funds between accounts and view their account balance. This is made even more convenient with our mobile banking app. We have an array of payment methods including payment by debit card which can be made 24/7. And we can now lend up to €75,000 up to a period of 10 years.

March 2019

We started refurbishments on our building in late 2018 and are delighted with the finished look. We now have a bright, spacious and modern building fully assessable for wheelchair users. Our offices now offer a more welcoming and pleasurable environment to conduct your credit union business in.