What can I borrow for?

7.99 (8.29% APR)

Our Motor Loan promotion at 7.99% allows you to borrow up to €75,000 over a period of 7 years.

With our improved online service, we can provide "Loan Approval in Minutes".

Discover our Loans

Find the right loan for you and we'll give you the right support.

Maximum Loan Term :

This calculator is for illustrative purposes only, to give you, the borrower, an overview of the potential cost of borrowing. The Credit Union, or any of its staff, cannot be held responsible for any errors. Please note that this calculator only provides an indicative quote and actual repayments may vary.

Rep. Example for Motor Loan

Loan amount

€10,000

Interest rate - APR

8.29% APR

Loan term

5 Years

Monthly

€203

Weekly

€47

Interest

€2,163

Need more Information?

contact our lending team by email loans@palmerstowncu.ie or by phone at 01 626 5621.

Warning - if you do not meet your repayment, your account can go into arrears. This may affect your ability to take a loan in future.

Warning - Loans are subject to T&C's.

*Subject to documentation

Palmerstown Credit Union is regulated by the Central Bank of ireland. (79CU)

Frequently Asked Questions

Everything you need to know

The fastest way to apply for a loan is online through the APP or the website. You can also apply over the phone at (01) 626 5621 or by making an appointment for a time suitable to you.

No. You do not need to save before applying for a loan. We look at your ability to repay and not your savings record or length of membership.

We offer Personal Loans up to €75,000 and Mortgages up to €250,000.

We aim to turnaround our loan applications in 24hrs (subject to Terms & Conditions). To speed up the process, we recommend that members submit all the relevant paperwork along with their application. This can also be done through uploading them through the APP or website or dropping them in the office.

You can also opt to use our Open Banking service that allows us to retrieve your bank statements directly from the bank, hence eliminating the need for printed copies.

Yes. Many members in the credit union apply for a top-up of their existing loan or apply for a new loan before repaying the loan in full.

You can repay your loan by the following methods:

Standing Order

Direct Debit

Online Payments

In Office

Each loan application is reviewed by assessing a number factors, including and not limited to;

- Ability to repay.

- Savings and loan account history.

- We are also required carry out credit checks with the Central Credit Registry (CCR).

Guarantor

In the case where an individual is proposing a guarantor, we must also carry out a similar evaluation of the guarantor’s ability to repay the loan in the event that the member gets into financial difficulty. We do this in order to protect each and every one of our Members’ savings.

We will always encourage members’ who may find themselves in financial difficulty after taking out a loan to engage with us as soon as possible so that we can work with them in coming up with a solution.

Lending Terms & Conditions Apply

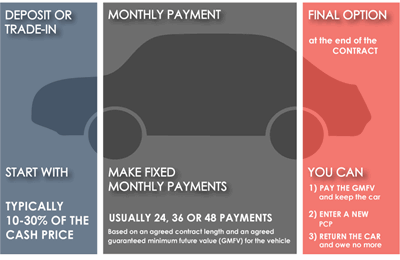

Personal Contract Plan v/s CREDIT UNION MOTOR LOAN

A PCP may appear attractive in its offering, but may involve complex terms and conditions.

- You may need to pay a deposit

- You may need to pay based on contract plans (24, 36 or 48 months)

- You will not OWN the car

- You may need to pay extra to get out of the contract

Ready to Apply?

To ensure a smooth application process, we’ll ask for:

- 3 most recent payslips

- Proof of any other household income

- Bank statements for the past 3 months

NOTE: Additional documentation may be requested depending on your circumstances.

Once your application and supporting documents are submitted, one of our team members will get back to you as soon as possible with an update.

Apply Now

Car Insurance

Planning to hit the road? Make sure you’re covered with our partners, Peopl Insurance. Whether you’re insuring your first car or looking for comprehensive cover as a seasoned driver, we’ve got your back.

Click the link below for more information.

Learn MoreHow to Apply

Apply for a loan either online or in branch.

Let’s Talk About Your Goals!

Our friendly team is here to help you with any inquiries you may have.